Understanding the Costs of Acquiring Property in Spain in 2024

Exploring the financial landscape of property purchase in Spain for the year 2024 reveals a blend of excitement and complexity, particularly for expatriates embarking on purchasing real estate abroad for the first time. This journey, while thrilling, brings with it a set of challenges and differences from the property buying process in other countries. It's crucial for potential buyers to not only consider the property's price but also to account for additional expenses such as property tax in Spain and various mortgage-related fees. This guide aims to demystify the taxes and fees associated with purchasing a home in Spain in 2024.

Securing a Mortgage and Other Essential Expenses

The path to homeownership in Spain involves navigating beyond just the mortgage. Spanish banks typically offer financing up to 80% of the property's value for primary residences, necessitating buyers to have at least 20% of the property's value for the down payment. However, the financial planning doesn't stop there. Buyers must also prepare for additional expenses including property taxes and various fees, which are crucial for completing the home buying process. Depending on the property's location and value, experts recommend setting aside an extra 10% to 12% of the property's price to cover these costs, in addition to the down payment.

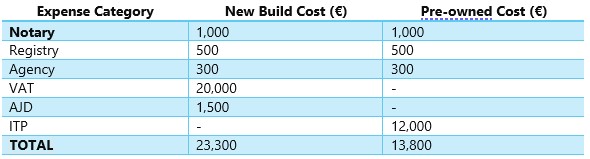

Breakdown of Property Purchase Costs

Key Fees and Taxes for Property Acquisition

The acquisition of Spanish real estate comes with a myriad of fees and taxes. Buyers must be prepared for costs such as the property transfer tax or VAT, which varies from 6% to 10% for resale properties and is fixed at 10% for new constructions. Stamp duty also applies, generally ranging from 1% to 1.5% of the property price. Notary fees, land registry charges, legal costs (typically 1-2% of the property price), and additional expenses such as mortgage fees, real estate agent commissions, property survey fees, utilities setup, and home insurance should also be factored into the budget.

Notarial Fees

In Spain, notaries perform tasks akin to those of solicitors in the UK during property transactions, with their fees being government-regulated to ensure uniformity. The cost of notarial services can vary depending on the property's value, generally falling between €600 and €875.

Land Registry Costs

Registering the property deeds is another step that incurs fees, which are set according to Spanish law and vary based on the property's price, typically ranging from €400 to €700.

Taxes on Property Purchases

Taxes represent a significant portion of the additional costs when buying property in Spain. New properties are subject to VAT (IVA), which is 10% in 2024, with variations for special cases like the Canary Islands or public subsidised housing. Stamp duty (IAJD) is also applicable for new constructions, with rates varying by autonomous community. Resale properties incur the Property Transfer Tax (ITP), with rates also varying but generally lying between 6% and 10%.

Optional Advisor Costs

Hiring an adviser or 'gestor' is optional but can be incredibly helpful for expats, especially for those who are not fluent in Spanish. The cost for such services is approximately €300, often utilized for managing mortgage applications and related paperwork.

Mortgage-Related Expenses

Even without the need for a mortgage, all the aforementioned taxes and fees apply. However, mortgage applicants must consider additional costs such as property valuation fees (€250 to €600 in 2024) and potential bank fees for opening an account or the mortgage itself, which can be up to 2% of the loaned capital.

Total Acquisition Costs

The combined total of taxes and fees for purchasing property in Spain can range from 10% to 12% of the property's purchase price, varying by the property's value and the location of the purchase.

For instance, buying a €200,000 property in Marbella could result in the following estimated costs, accounting for notary fees, professional fees, and taxes, among others:

This detailed overview aims to provide a clearer understanding of the costs involved in purchasing property in Spain in 2024, highlighting the importance of thorough financial planning for prospective buyers.